The 411 on 529 Plans

/By: Aaron Graham

Hitting the books without breaking the bank

What are they?

With the rising cost of college, paying for higher education can be a daunting thought. However, 529 college savings plans can make things a little less scary. A 529 is an investment account that offers a tax-advantaged way to save for education expenses. Named for the section of the Internal Revenue Code which was created for them in 1996, these “Qualified Tuition Plans” are offered by all 50 states and the District of Columbia.

Who can open a 529?

Almost anyone can open a 529 for themselves or a family member, provided the account owner is age 18 or older. Most often, a parent will open a 529 and name their child as the beneficiary. The owner of the account has the power to contribute to the account, invest the funds within the account, withdraw from the account, and change the named beneficiary on the account.

What are the tax benefits?

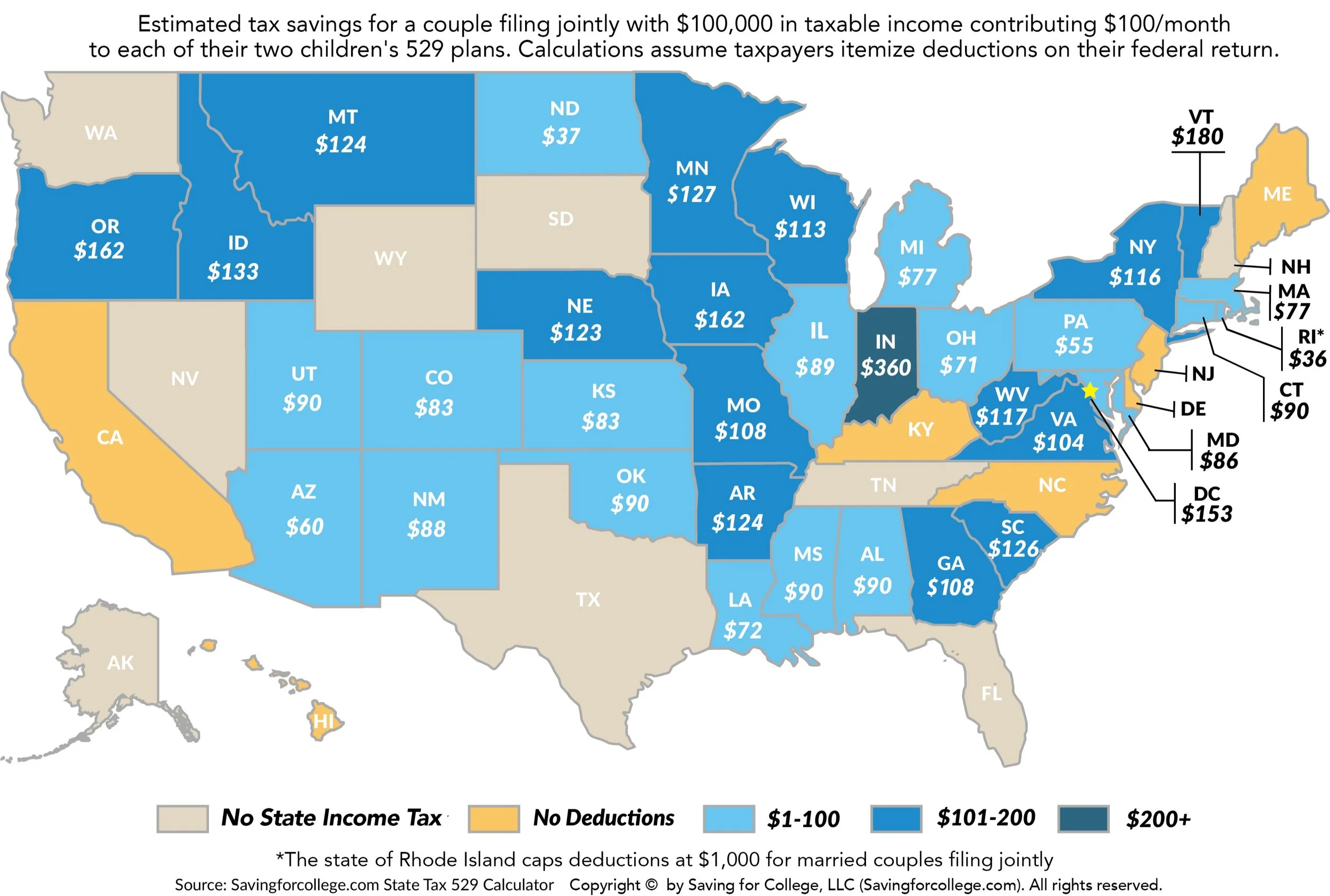

Your contributions grow on a tax-deferred basis and distributions are tax-free if used for qualified education expenses. The longer your contributions are invested, the more you can take advantage of the tax-deferred growth that makes 529s so attractive. Depending on where you live, your contributions may also provide tax savings on your state return. More than 30 states currently offer a tax deduction or credit for contributions. See the map below and this list for details on eligibility for state tax benefits.

What are qualified education expenses?

Qualified expenses refer to costs that are required to attend a postsecondary school and include tuition and fees; books, supplies, and equipment; room and board, etc. You can see the full list of qualified expenses on the IRS’s website here.

“Qualified” historically only applied to college and graduate school expenses. The Tax Cuts and Jobs Act of 2017 expanded that definition to include up to $10,000 per year in private school K-12 expenses and a $10,000 lifetime limit on student loan debt repayments.

How much can I contribute and can I overcontribute?

While there are no annual contribution limits, contributions to 529 plans are considered gifts for tax purposes. This means that contributions in excess of the annual gift tax exclusion ($16,000 for 2022) count against your lifetime gift and estate tax exemption ($12.06 million for 2022).

So, can you contribute too much to a 529? Perhaps. If your child doesn’t go to school, earns scholarships, or uses the 529 for a non-qualifying expense, distributions are subject to a 10% penalty and the earnings are considered taxable income. Therefore, we recommend you target saving enough to cover 60-70% of the full cost to attend a major in-state university since a shortfall can be made up by funds from a number of other sources such as paying for school out of cash flow, having your child work part-time, and taking out student loans.

One often-overlooked feature of 529s is that you can also change the beneficiary if the initial beneficiary doesn’t need the funds. You may change the beneficiary to another qualified family member (e.g. a sibling, parent, niece or nephew, etc.). See the full list of eligible family members according to the IRS.

“...we recommend you target saving enough to cover 60-70% of your child’s cost to attend a major in-state university, since a shortfall can be made up by funds from a number of other sources.”

How does a 529 plan factor into financial aid?

A student’s resources are reported on the FAFSA (Free Application for Financial Student Aid). However, in general, the impact of 529 plan assets is limited and depends on who the account owner is.

The FAFSA considers 529 plan assets owned by a parent as parental assets. Parental assets above $10,000 are included in the Expected Family Contribution (EFC) at a maximum of 5.64%. Assets in a student’s name are generally counted at 20%, so having the parent as the account owner often makes the most sense. The US Department of Education has proposed changes that may limit the impact of grandparent-owned 529 plans on financial aid eligibility, but those changes have not been finalized as of this writing and may reduce a student’s financial aid eligibility by as much as 50%. If your child’s grandparents have a 529 for them, it’s best to use it for the last two years of attendance so it won’t factor into the EFC calculations.

How are the funds invested?

Investment options will vary depending on which state’s 529 plan you participate. Many states offer target enrollment date options, which adjust the portfolio to be more conservative as the beneficiary nears their enrollment date. We have found Utah’s my529 savings plan to be one of the best options with low fees and a diversified investment offering, particularly if your state (e.g., California) doesn’t offer tax savings on contributions.

Is a 529 right for me?

Maybe. How you pay for school is a personal decision and there is no one right answer. 529 plans offer a myriad of tax benefits, but there are other ways to set aside money for your children, for school or other expenses, such as custodial accounts. Providing for your children is also only part of your overall financial plan. If you want help putting all the pieces of the puzzle together, reach out to us today.